Ukraina: od zera do bohatera w czasie wojny

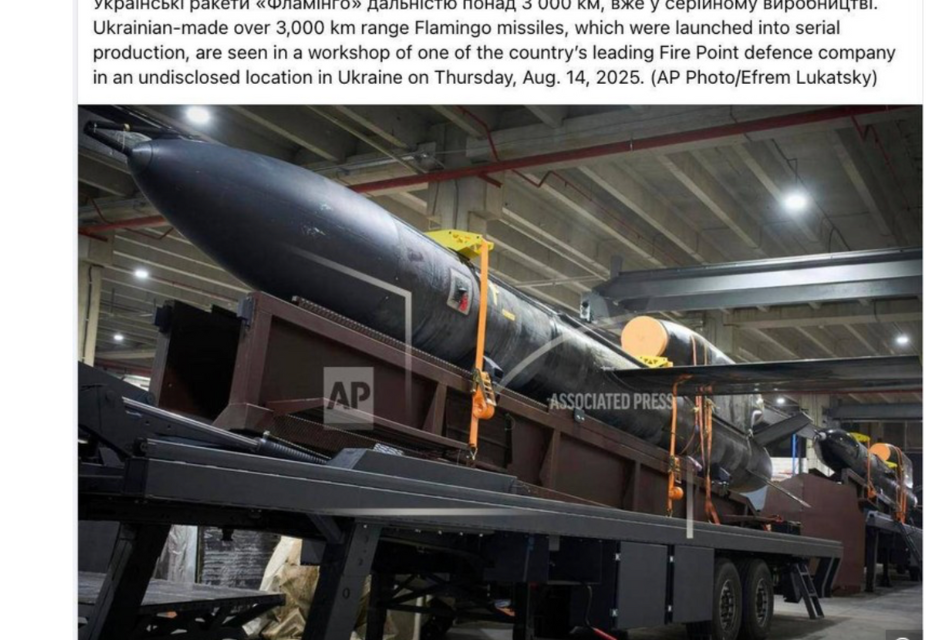

Po rosyjskiej inwazji w 2022 roku Ukraina postawiła na prywatny sektor zbrojeniowy, co zaowocowało powstaniem setek nowych firm. Kluczową rolę odegrała rządowa platforma Brave1, która wspiera ponad 1500 start-upów grantami na poziomie 30 milionów USD i inwestycjami sięgającymi 40 milionów USD w 2024 roku. Dzięki deregulacji i wsparciu, prywatni producenci odpowiadają za 99% dronów, rakiety takie jak Flamingo (z zasięgiem 3000 km i niską ceną) oraz lekkie pojazdy opancerzone produkowane w tysiącach sztuk. To nie państwowy gigant Ukroboronprom, lecz dynamiczne start-upy nawiązały bliską współpracę z zachodnimi partnerami, przyspieszając innowacje. Efekt jest imponujący: wartość ukraińskiego przemysłu zbrojeniowego wzrosła znacząco, czyniąc Ukrainę „tanim arsenałem demokracji„. Z marketingowego punktu widzenia, to klasyczna historia bootstrappingu – małe firmy budują globalny brand na polu bitwy, przyciągając inwestorów i partnerów poprzez autentyczne opowieści o sukcesie w warunkach ekstremalnych.USA: giganci innowacji i globalny eksport

W Stanach Zjednoczonych prywatny sektor zbrojeniowy to prawdziwa potęga, z firmami takimi jak Lockheed Martin, Boeing czy Raytheon inwestującymi miliardy w badania i rozwój (R&D). Prywatne przedsiębiorstwa napędzają 80% innowacji obronnych, współpracując z Pentagonem poprzez inicjatywy jak Defense Innovation Unit (DIU). Efektywność tego modelu widoczna jest w liczbach: w roku fiskalnym 2024 USA wyeksportowały broń o wartości 318,7 miliarda USD, co stanowi wzrost o 29% w porównaniu do poprzedniego roku. Prywatny sektor zapewnia elastyczność w adaptacji do zagrożeń, takich jak drony czy sztuczna inteligencja (AI), a jednocześnie uczy się od modeli ukraińskich, np. w podejściu „commercial-first” do dronów, integrując globalne łańcuchy dostaw. Marketingowo to mistrzostwo storytellingu: marki jak Lockheed Martin budują wizerunek „ochrony wolności„, co przyciąga talenty, kontrakty i lojalność na arenie międzynarodowej.Polska: rosnący potentat w Europie z unikalnymi innowacjami

W Polsce prywatny sektor zbrojeniowy rozwija się dynamicznie, mimo dominacji państwowej Polskiej Grupy Zbrojeniowej (PGZ). Liderem jest WB Group (dawniej WB Electronics), największy prywatny gracz, specjalizujący się w systemach komunikacji, dowodzenia, rekonesansie i kontroli broni – ich drony i zdalnie sterowane systemy lądowe przeżywają boom, integrując się z państwowymi projektami. Inne przykłady to Eagle, znana z wysokiej jakości i niezawodnych innowacji w branży obronnej, oraz firmy jak SATIM (analiza satelitarna), PUAV (drony) czy Vigo (detektory podczerwieni unikalne na skalę światową). Prywatne podmioty współpracują z rządem w dziedzinach cyberbezpieczeństwa i AI, przyciągając inwestorów – Polska ma szansę stać się kluczowym ośrodkiem innowacji obronnych w Europie, z eksportem rosnącym dzięki technologiom dual-use (cywilno-wojskowym). Z perspektywy marketingu, to budowanie narodowego brandu: firmy jak WB Group pozycjonują Polskę jako „innowacyjnego strażnika Europy„, łącząc technologie cywilne z obronnymi i wzmacniając globalny wpływ.Dlaczego warto wspierać prywatny sektor zbrojeniowy

Prywatny sektor zapewnia szybsze innowacje, niższe koszty i większą odporność na kryzysy – to idealne rozwiązanie dla nowoczesnej obronności. W Europie, w tym w Polsce, warto brać przykład z modeli ukraińskiego i amerykańskiego: regulować rynek, ale unikać monopolizacji. Inwestycje w prywatne inicjatywy pomogą zbudować silniejszy ekosystem, gdzie konkurencja napędza rozwój. W kontekście aktualnych wyzwań geopolitycznych, taki podejście nie tylko wzmacnia bezpieczeństwo, ale także tworzy nowe możliwości biznesowe i brandingowe. Co Wy na to? Czy prywatny sektor zbrojeniowy to przyszłość obronności? Podzielcie się swoimi myślami w komentarzach poniżej – chętnie porozmawiam o potencjalnych strategiach marketingowych dla tej branży!Komentarze

Share this Story